Illustration on Calculation of Fixed Assets Turnover Ratio is: Particulars

#Working capital turnover ratio how to

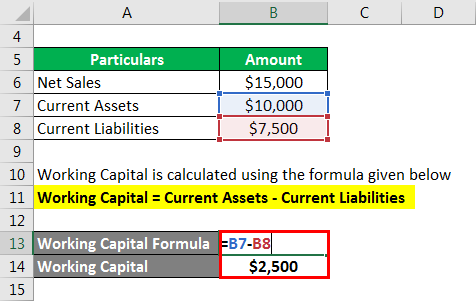

Working Capital = Current Assets – Current Liabilities How to Calculate Working Capital Turnover Ratio?

Net Sales = Total Sales – Returns – DiscountsĪverage Working Capital = (Working Capital on The Beginning of the Period + Working Capital on The End of the Period) / 2 Working Capital Turnover Ratio = Net Sales / Average Working Capital The Formula for the Working Capital Turnover Ratio is: Such assets are known as current liabilities. Similarly, liabilities such as accounts payable, wages, taxes payable, advance received, interest payable, monthly loan installments are due within one year. Hence, these assets are described as current assets. Assets such as cash-in-hand, bank balance, accounts receivable, inventory, advance paid are expected to be liquidated or converted into cash in less than a year. It is calculated using the assets and liabilities listed on a company’s balance sheet. The difference between a company’s current assets and current liabilities is known as working capital.

This would in turn potentially lead to a large number of bad debts and obsolete inventory write-offs. A low ratio, on the other hand, shows that a company is investing too much in accounts receivable and inventory assets to sustain its sales. Companies that have a greater working capital turnover ratio are more efficient in their operations and revenue generation.Ī high turnover ratio suggests that management is maximising the use of a company’s short-term assets and liabilities to boost sales. After all obligations have been met, this method gives a company an accurate estimate of how much money it has available to allocate toward operations (debts, bills, etc.). Working capital turnover is critical for any company. This ratio is also known as the net sales to working capital formula. Working capital is the operating capital that a company utilizes in its day-to-day activities. The working capital turnover ratio is an accounting ratio that determines how effectively a business utilises its working capital to generate revenue. Disadvantages of Using a Working Capital Turnover Ratio.Advantages of Using a Working Capital Turnover Ratio.Interpretation of Working Capital Turnover Ratio.How to Calculate Working Capital Turnover Ratio?.What is Working Capital Turnover Ratio?.

0 kommentar(er)

0 kommentar(er)